Shipbreaking picks up pace at Gadani

19/5/2009#0183;#32;Fearing reimposition of customs duty and sales tax in the new budget importers are trying hard to bring in as many vessels as they can before the end of current fiscal year on June 30.

WhatsApp)

WhatsApp)

19/5/2009#0183;#32;Fearing reimposition of customs duty and sales tax in the new budget importers are trying hard to bring in as many vessels as they can before the end of current fiscal year on June 30.

#0183;#32;Following the Budget, duty rates on cigarettes and cigars will increase by RPI + 2%, while the rate on handrolling tobacco will increase by RPI + 6%, effective from 6pm today (11 March 2020). This means you pay an extra 27p on a packet of 20 cigarettes and an extra 67p on a 30g packet of handrolling

#0183;#32; Rolls for rolling mills Search updated Central Excise Duty and Tariff of Years 2009, 2008, 2007 and 2006. Details of Modvat and cenvat.

Excise duty 2019 Excise duty 2020; Cigarettes 200 #163; #163;: Hand rolling tobacco 250 grams #163; #163;: Spirits 40% ab v 1 litre #163; #163; 70cl #163; #163;: Wine 1

Article discusses Legislative changes vide union budget 2017 regarding Authority for Advance Ruling/ Settlement of Cases, Amendments involving change in the duty rates, applicability of Section 5A of the Excise Act in respect of inputs imported or exported by EOU, Amendment in the Central Excise Rules, 2002, Changes in duty rates regarding commodity falling under Renewable Energy etc.

Fearing reimposition of customs duty and sales tax in the new budget importers are trying hard to bring in as many vessels as they can before the end of current fiscal year on June 30. Ali Sher

UNION BUDGET . In the budget 2012, excise duty on automobile chassis was increased to 14% which needs to be reduced to 13% in case of chasis for tippers and normal load for wind mills are custom made and designed to take very heavy load.

10/3/2008#0183;#32;Bangladeshs The New Nation reported that steel makers and rolling mills have demanded waiving duty on melting scrap as has been done by India in its new budget to keep the price down.

Excise Duties 1. Imported private motor vehicles of engine capacity not exceeding 2500, shall attract excise duty of 30% 2. Those exceeding 2500 and not exceeding 3000, shall attract 35%. This is up from the current 20%. Money transfers 1. % for every 50,000K transferred. 2. Mobile phone transfers excise duty rate of 20% up from 10% 3

COMMISSIONER OF CUSTOMS AND C. EX Vs. VANDANA ROLLING MILLS LTD Judgment Dated of high court of chhattisgarh having citation (2016) 331 ELT 236, include bench Judge Navin Sinha, Sam Koshy, J. having Advocates For Petitioner : Shri Maneesh Sharma, Advocate, for the Appellant; Shri Ramakant Mishra, Advocate, for the Respondent

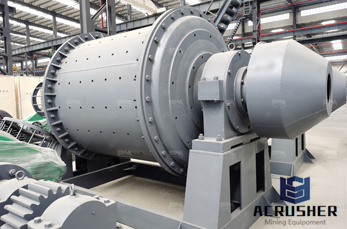

New Budget For Excise Duty On Rolling Mills We are a largescale manufacturer specializing in producing various mining machines including different types of sand and gravel equipment, milling equipment, mineral processing equipment and building materials equipment.

Tariff Code Of Ball Mill In Capital Goods In Cental Excise. Jaw crusher working principle a doubletoggle jaw crusheroutweighs the singletoggle by a factor of 2x and well as cost more in capital forthe sam the blake type jaw crusher has a fixed feed area and. Jaw Crushers. This series of jaw crusher belongs to stone crushing equipment which is widely used in the works of

Metalrolling mills and rolls therefor Search updated Central Excise Duty and Tariff of Years 2009, 2008, 2007 and 2006. Details of Modvat and cenvat.

The appellants were holding a Central excise registration certificate and were clearing the goods on payment of Central excise duty till . They surrendered their Central excise registration certificate with effect from . A showcause notice was issued under the Act on to show cause as to why the duty amounting to Rs 2,14,780 for the period from 131994 to

29/3/2013#0183;#32;Budget, 2011 has brought the excise duty on the utensils 1% under Notification no. 1/2011CE dated on the condition that no credit is availed. Also an option was given in this budget to pay the excise duty on utensils 5% under Notification no. 2/2011CE dated alongwith the facility of Cenvat credit. Since 1% duty was not a big deal, most of the manufacturers

mill drive of the finishing mill excluding any pinch roll. Such a pinch roll is not a finishing stand. (4) the Commissioner of Central Excise shall, as soon as may be, after determining the total capacity of the hot rerolling mill installed in the factory as also the annual capacity of production, by an order, intimate to the manufacturer.

Tobacco excise delivered a massive billion to government coffers in the last financial year. However, this tax is particularly cruel at a time of zero wage growth .

new budget for excise duty on rolling mills. tariff code of ball mill in capital goods in cental excise. tariff code of ball mill in capital goods in cental excise Ball mills are used primary for single stage fine grinding regrinding and as the second stage in two stage grinding circuits According to the need of customers ball mill .

new budget for excise duty on rolling mills. tariff code of ball mill in capital goods in cental excise. tariff code of ball mill in capital goods in cental excise Ball mills are used primary for single stage fine grinding regrinding and as the second stage in two stage grinding circuits According to the need of customers ball mill . Chat Online; Kolkata Cylindrical Grinding Machine Vetura

WhatsApp)

WhatsApp)